Nationwide protects more than 1,000,000 pets

- Pet insurance premiums starting at $25/mo.

- Visit any licensed veterinarian in the United States

- Cancel at any time, risk-free

Complete coverage.

Complete confidence.

Customize your pet insurance policy to find the best coverage for your monthly budget.

Does your employer offer pet insurance?

How pet insurance works

A pet insurance plan lets you give your furriest family members the best health care possible by reimbursing you for eligible veterinary costs.

- 1

Visit your vet

Visit any licensed veterinarian in the United States or anywhere else in the world.

- 2

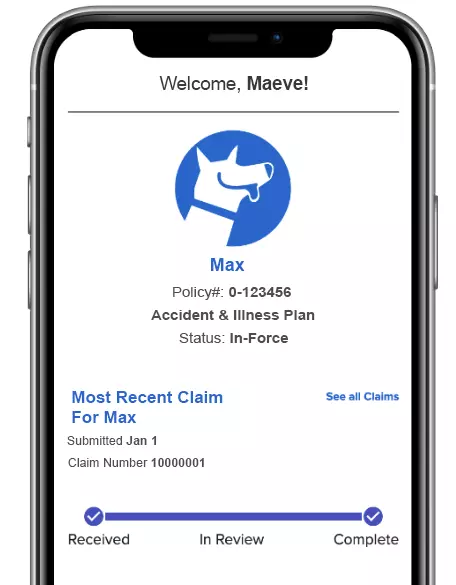

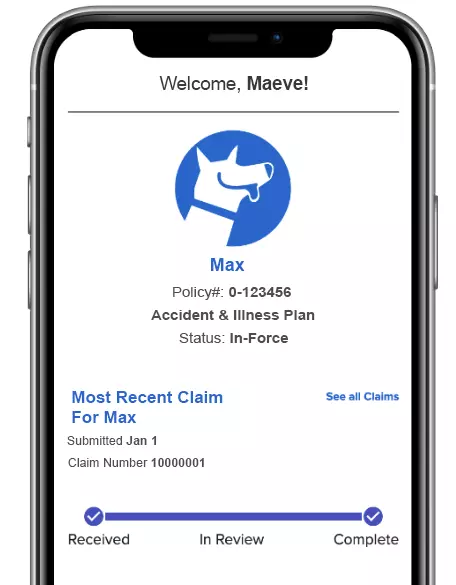

Submit claims

Quickly and easily submit claims online for things like illnesses, injuries or emergency care.

- 3

Receive cost reimbursements

Receive reimbursements for eligible vet costs covered under your policy terms.

Frequently Asked Questions

Absolutely. All our plans can be used with any licensed veterinarian, anywhere in the world—even specialists and emergency providers. Get a no-obligation quote.

We offer nose-to-tail coverage for:

- Accidents, including broken bones, sprains, lacerations and poisoning

- Illnesses, including allergies, ear infections, arthritis and cancer, and more

- Preventive care, including checkups, vaccinations and flea/tick preventive

Once you’ve met your annual deductible, we’ll reimburse you for eligible veterinary expenses according to the percentage or benefit schedule you selected for your plan, up to the applicable policy limit.

Say you have a $250 annual deductible with $5,000 in accident coverage at 90% reimbursement. Now let’s say your dog broke a leg and the vet bill was $2,500, of which $2,400 was covered (we don’t cover non-medical things like tax and waste disposal). After your deductible and 90% are applied, we’d reimburse you $1,935, leaving you with $3,065 in remaining accident coverage for the remainder of your policy term.

Never. To get the best coverage options, enroll your pet before age 8, and be sure to keep your policy continually in force (translation: don't let it lapse or expire). We promise not to drop your pet because of age. After all, we're pet lovers, too!

Absolutely. You can cancel anytime at my.petinsurance.com or by letting us know in writing.

We even have a 100% money-back guarantee if you cancel within 10 days* of when your policy went into effect and we haven’t reimbursed you for any claims in that time.

If you decide to cancel later on, no problem—we’ll simply refund your unused premium.

* Terms may vary by state.

The best pet insurance for you is one that provides a level of coverage you’re comfortable with and fits your budget for monthly premiums. When choosing your plan, consider how much medical care (for accidents and illnesses) is typical for your pet’s breed and whether you want wellness coverage for preventive care.

Yes. A 14-day waiting period applies, starting from the time your application is approved and we receive payment.

If you’re enrolling as part of a group or organization, effective dates vary.

Nationwide offers annual deductible options as low as $100 on some plans. Most pet owners choose a $250 annual deductible.

Items such as grooming, tax, waste disposal, boarding, or pre-existing conditions are not eligible for coverage. See policy documents for a complete list of exclusions.

A lot of pet insurance companies have come and gone. The key to picking one you can count on is stability and experience. Some insurance companies pay to use the names of well-known organizations. With Nationwide, what you see is what you get: one of the largest and most trusted financial services companies in the world.

Monthly premiums for new enrollments depend on your pet’s breed and age, the type of coverage selected and your ZIP code.